Research Affiliates® Global Multi-Asset Index

Research Affiliates® Global Multi-Asset Index

A forward–looking index designed to benefit from where markets are headed, not where they have been. The Index provides diversified exposure to global stocks, bonds, and commodities, while utilizing a proprietary risk management process to manage volatility. The Index is grounded upon three core principles:

Helpful resources

Global Diversification

To help provide broader diversification and the opportunity for greater growth through changing markets, the Index provides access to 22 assets including global stocks, global bonds and commodities.

Forward–Looking Perspective

The Index incorporates proprietary forecasting models of the long-term expected returns to each asset class. It then uses this information to identify and systematically and optimally allocate to assets that are expected to perform well going forward.

Return Stabilization

To help provide more stable returns through volatile markets, the Index uses a proprietary volatility control methodology to improve accuracy and precision.

Global Diversification

The Research Affiliates® Global Multi-Asset Index provides diversified exposure to six global stocks, six global bonds and 10 commodities.1 The flexibility to allocate to a broad universe of global asset classes offers growth opportunities in a variety of market environments.

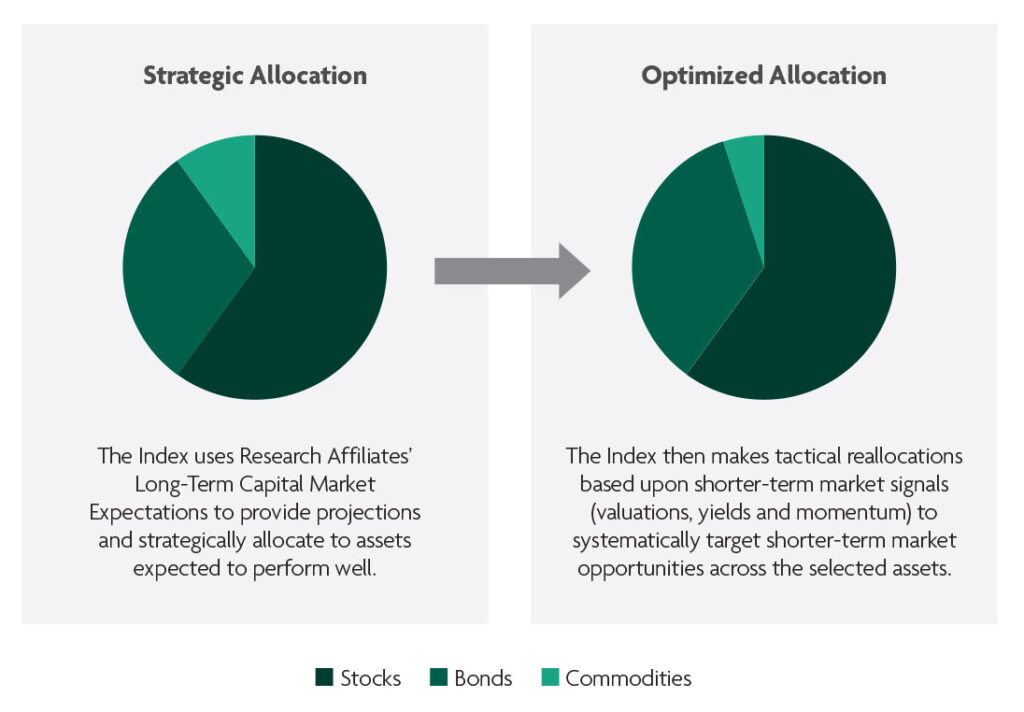

Dynamic Forward-Looking Allocation Process

Leveraging Research Affiliates’ experience in forecasting returns and deep expertise in multi-asset investing, the Index first creates a strategic allocation using its long-term forecasting models. It then makes tactical reallocations to the selected stocks, bonds and commodities using shorter-term quantitative signals to help determine an optimized allocation each month.

The Index also applies a proprietary daily volatility control methodology designed to help stabilize returns through changing markets. The Index rebalances daily between the monthly selected allocation of equity, bond and commodity allocations and interest free cash to help maintain a longer term volatility target of 5%.

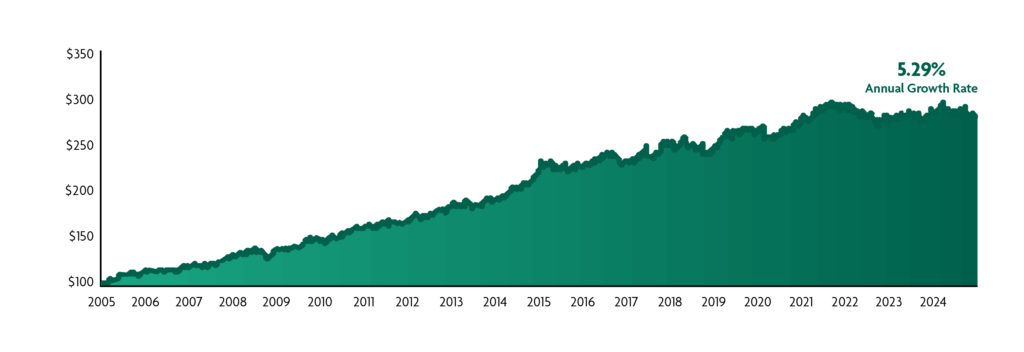

Historical Performance

The Research Affiliates® Global Multi-Asset Index leverages global diversification, forward-looking perspective and an optimization process with the aim to provide stable, long-term returns through changing market environments. The graph below shows how the Index would have provided relatively consistent growth had it been available in past markets.

Index performance from 1/3/2005 through 12/31/2024. The index performance shown is hypothetical and for illustrative purposes only and does not represent the performance of a specific product. The Research Affiliates Global Multi-Asset Index was established on 11/24/2023. Performance before this date is back-tested. Hypothetical performance is back-tested by applying the Index methodology to historical financial data when all components were available and was designed with the benefit of hindsight. Back-tested performance is hypothetical and has been provided for informational purposes only. Past performance is not a guarantee of any future performance.

Explore the growth opportunities available with the Secure Horizon FIA Suite.

1 The global stocks, bonds and commodities are futures allocations.

The Research Affiliates® Global Multi-Asset Index (the “Index”) is a service mark of RAFI Indices, LLC or its affiliates (collectively, “RAFI”) and has been licensed for certain use by North American Company for Life and Health Insurance® (“the Company”). The intellectual and other property rights to the Index are owned by or licensed to RAFI. Use and distribution of the Index or any included data and RAFI’s service marks requires RAFI’s written permission. This annuity (the “Product”) is not sponsored, endorsed, sold or promoted by RAFI or any of its third-party service providers or suppliers including data licensors and index calculators (“RAFI and its suppliers”).

The Index is an excess return index and does not allocate to any interest-bearing cash rate allocations. Because of this, an excess return version of an index will have lower performance than a total return version of the same index would, especially in high interest rate environments.

Past performance of an index is not an indicator of or a guarantee of future results. Hypothetical and simulated examples have inherent limitations and are generally prepared with the benefit of hindsight. There are often differences between simulated results and the actual results. There are numerous factors related to the markets in general or the implementation of any specific investment strategy, which cannot be fully accounted for in the preparation of simulated results and all of which can adversely affect actual results. RAFI and its suppliers make no representations or warranties regarding the advisability of investing in the Product or the ability of the Index to provide any particular market performance. RAFI is not acting as an investment adviser to you and has no fiduciary duties to you in connection with the Index or the Product. RAFI and its suppliers are not responsible for and have not participated in the (i) development, marketing, issuance or management of the Product, (ii) the determination of the timing of, prices, at or quantities of the Product to be issued, or (iii) calculation of the equation by which the Product is redeemable. RAFI and its suppliers have no obligation or liability to the owners of the Product and any decision to purchase or invest in the Product is at your own risk. RAFI and its suppliers obtain information from sources they consider reliable but do not guarantee the accuracy, completeness or completeness of the Index or any data included therein, all of which are provided on an “as is” basis.

RAFI and its suppliers make no warranty as to the results that may be obtained by the Company, the Company’s customers and counterparties, owners of the Product or anyone else from the use of the Index or included data as licensed or for any other use. RAFI and its suppliers disclaim all warranties and representations, including any warranties of merchantability or fitness for a particular purpose or use, with respect to the Index or any included data. In no event will RAFI or its suppliers be liable for any damages, including direct, indirect, special, punitive and consequential damages (including lost profits), even if notified of the possibility of such damages. Fixed index annuities are not a direct investment in the stock market. They are long term insurance products with guarantees backed by the issuing company. They provide the potential for interest to be credited based in part on the performance of specific indices, without the risk of loss of premium due to market downturns or fluctuation. Although fixed index annuities guarantee no loss of premium due to market downturns, deductions from your accumulation value for optional benefit riders or strategy fees or charges associated with allocations to enhanced crediting methods could exceed interest credited to the accumulation value, which would result in loss of premium. They may not be appropriate for all clients. Interest credits to a fixed index annuity will not mirror the actual performance of the relevant index.

Fixed index annuities are not a direct investment in the stock market. They are long term insurance products with guarantees backed by the issuing company. They provide the potential for interest to be credited based in part on the performance of specific indices, without the risk of loss of premium due to market downturns or fluctuation. Although fixed index annuities guarantee no loss of premium due to market downturns, deductions from your accumulation value for optional benefit riders or strategy fees or charges associated with allocations to enhanced crediting methods could exceed interest credited to the accumulation value, which would result in loss of premium. They may not be appropriate for all clients. Interest credits to a fixed index annuity will not mirror the actual performance of the relevant index.

Annexus and their affiliated agencies are independently contracted with North American Company for Life and Health Insurance.

The North American Secure HorizonSM, Secure HorizonSM Plus, and Secure HorizonSM Accelerator are issued on form NA1015A/ICC21-NA1015A (Contract), AE651A/ICC21-AE651A (Secure Horizon/Secure Horizon Accelerator only), AE652A/ICC21-AE652A, AE653A/ICC21-AE653A (Secure Horizon/Secure Horizon Accelerator only), AE654A/ICC21-AE654A, AE655A/ICC21-AE655A, AE682A/ICC23-AE682A (Secure Horizon Accelerator only), AE642A/ICC20-AE642A, AE638A/ICC21-AE638A, AE639A/ICC21-AE639A, AE656A (Secure Horizon Plus only), AE658A (Secure Horizon Plus only), AE659A (Secure Horizon Plus only), AE660A04 (Secure Horizon Plus only), (riders/endorsements) or appropriate state variation. These products, features, and riders may not be available in all states.

Sammons Financial® is the marketing name for Sammons® Financial Group, Inc.’s member companies, including North American Company for Life and Health Insurance®. Annuities and life insurance are issued by, and product guarantees are solely the responsibility of, North American Company for Life and Health Insurance.

33714Z-1

REV 1-25